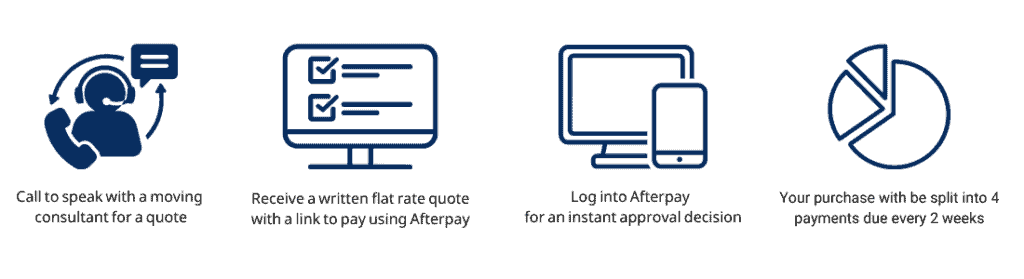

At Move for Less, we understand that moving can be both exciting and challenging. That’s why we’ve partnered with Afterpay, offering you the flexibility to pay for your move in manageable installments

Your Move, Your Way: Flexible Payments with Afterpay

How Afterpay Elevates Your Moving Experience

How Afterpay Elevates Your Moving Experience

Moving can be a significant financial undertaking, but with Afterpay, it doesn’t have to be a burden. Afterpay splits your moving costs into four equal payments, spread over eight weeks, with no interest or added fees when you pay on time. It’s straightforward and transparent – exactly what you need during a move.

1. Budget-Friendly Payments: By choosing Afterpay, you can manage your finances more effectively. Pay for your move in smaller, bite-sized installments instead of a larger lump sum, easing the financial load.

2. No Interest, No Surprises: We believe in clarity and simplicity. With Afterpay, what you see is what you get. No hidden fees, no interest charges. Just straightforward payments.

3. Quick and Easy Setup: No long forms to fill out or waiting periods. Get instant approval at checkout, so you can focus on the more important aspects of your move.

4. Flexibility and Convenience: Life is full of surprises, and flexibility is key. Afterpay gives you the freedom to allocate your funds where they are needed most, when they are needed most.

5. Trusted and Secure: Partnering with a reliable and secure service like Afterpay means your financial details are in safe hands, giving you one less thing to worry about during your move.

With Move for Less and Afterpay, moving becomes a less daunting task. We’re here to help you transition to your new home with ease and financial peace of mind. Start planning your hassle-free move today!

Yes, you can pay off your purchase early with Afterpay. There are no penalties for early repayment, and doing so can help you manage your finances more effectively.

Generally, Afterpay does not conduct a hard credit inquiry, which means checking your eligibility or using Afterpay won’t affect your credit score. However, missed payments or defaults may be reported, impacting your credit score.

You can learn more about Afterpay by visiting their official website or downloading their app. Both platforms provide detailed information about how Afterpay works, its terms and conditions, and FAQs.

Yes, refunds are possible for purchases made with Afterpay. The refund process usually follows the standard policy of the retailer. Once the retailer processes your refund, Afterpay will handle the reversal of payments or adjustment of your payment schedule accordingly.

Payments with Afterpay are typically made through the Afterpay app or website. You can link a debit or credit card to your Afterpay account, and payments will be automatically deducted according to your payment schedule.

Yes, there are spending limits with Afterpay, which may vary depending on factors like the length of time you have been using Afterpay, and your payment history. The inital limit for new users is typically $600. These limits are in place to encourage responsible spending.